By Joel Persinger

YourRealEstateDude.com

As the prices of San Diego County homes have come down and low introductory interest rates on many home loans have gone up, some San Diegans have found themselves owing more on their homes than the properties are worth. This has given rise to a sharp increase in foreclosures as home owners find it difficult to cope with the increase in their mortgage payments and see little incentive in holding on to homes that aren’t worth what’s owed on them. In addition to foreclosures, this has also brought about a rash of what are called, “Short sales”, and with them the age old question posed by sellers, “Should I try to sell it or just walk away?” While there is often no clear answer, the question did spark a debate among my agents during the weekly training meeting at my office this past week. But, before I share the highlights of that discussion, a short explanation of foreclosures and short sales is in order.

Foreclosure is the more commonly understood of the two terms. Essentially, it refers to the process by which a lender reclaims a property when a borrower has failed to make the required payments on the loan. The lender goes through “foreclosure” in order to sell the property for the purpose of recouping the money lent to the borrower.

By contrast, a short sale is an action taken by the borrower in order to avoid foreclosure. In this case, the borrower (or homeowner) attempts to sell the home in order to satisfy the loan. However, the value of the home has decreased to the point that the value is no longer sufficient to pay off the loan. If the homeowner places the property on the market and succeeds in finding a buyer at the home’s current market value, the lender will lose money on the deal. In this case, the lender would have to agree to take a loss for the difference between the amount of proceeds from the sale and the loan balance. If the lender accepts the deal, the property will have been sold “short” of the amount owed. Thus, it is called a “Short sale.”

The individual situation often dictates which option a homeowner will elect to take. It should be noted that there are pros and cons to each. In the case of short sales, while I have no way of confirming the assertion, I have heard many people claim that a short sale will not cause quite as great a ding on your credit report as will a foreclosure. This is often why homeowners will choose this path. However, a short sale requires a great deal of effort and significant disclosure of information. Among other things, the lender will require that the homeowner provide tax and financial records, draft a “hardship letter” explaining why the payments cannot be made and demonstrated a diligent effort to sell the property for the highest possible amount. By contrast, foreclosure is somewhat easier, in that you simply stop making payments and walk away from the property. Additionally, a foreclosure may not have the income tax ramifications of a short sale. In the case of a short sale, it is quite common for lenders to send the homeowner an IRS form 1099 for the amount of the lender’s loss. No such form is issued in the case of a foreclosure. However, as mentioned before, foreclosure may have a much worse effect upon the borrower’s credit rating.

If you find yourself in the unenviable position of having to choose between foreclosure and selling your home in a short sale, the best advice I can give is that you seek competent professional counsel prior to making any decision. At minimum, you should speak to both a tax advisor and an attorney. And make sure that both are knowledgeable and experienced.

Sunday, November 25, 2007

Monday, November 19, 2007

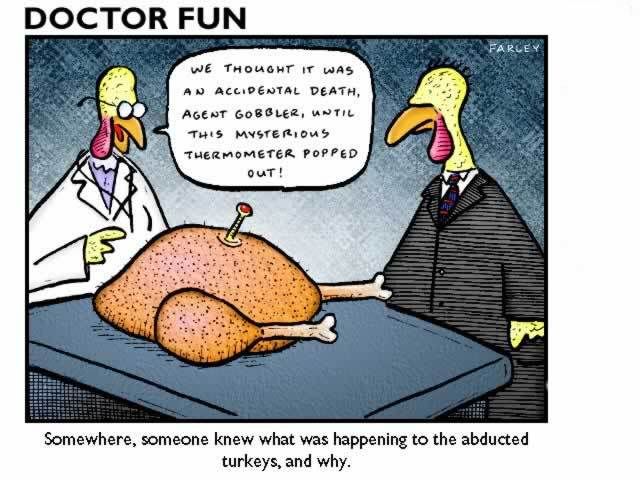

Being thankful, even when it’s tough.

By Joel Persinger

By Joel PersingerYourRealEstateDude.com

Now that the holiday season has arrived, the traditional “slow season” for real estate has begun. Folks are starting to focus on travel plans, family gatherings and last minute shopping sprees. Not many people want to move during this time of year, so sales of homes slow down considerably. As you’re reading this, you may be thinking, “What planet are you from, Joel? How could real estate possibly slow down any more than it already has?”

Indeed, this year has been a tough one for the real estate business and for anyone whose business is somehow connected to it. The crazy rise in prices of a few years ago, the collapse of the sub-prime lending market and the resulting credit crunch have all taken their toll on San Diego’s real estate marketplace and, more importantly, on San Diegans. Sales of both new and existing homes have been down dramatically, mortgage loans are more difficult to get even though interest rates are at historic lows, home prices have gone down to the point that many sellers simply cannot sell or even refinance and many real estate and lending professionals have either left the business or are on their way out and just don’t know it yet. Support industries have also suffered. Residential construction is a prime example. As you drive around San Diego County you don’t see all that many homes being built anymore. This means leaner times for contractors and the companies and workers they hire.

Tough times like these make being thankful during the season for “being thankful” that much more challenging. That is, unless we chose to focus on the positive. Your home may not be worth as much as it was before, but if you have one to live in, you are ahead of many millions of people around the planet who cannot say the same. We live in one of the richest cities in the richest state in the richest county in the world. Your bills may not get paid on time and maybe they won’t get paid at all, but you probably ate this morning. So did I. We’ll both probably eat well tonight too. In this city we have good, clean, running water, electricity that works well over 99% of the time, we can go where we please when we please and unlike the Middle East, where many of us have family or friends in harm’s way over the holidays, nobody blows up marketplaces, weddings or schools here. We even have it better than our counterparts on the East Coast. We have no snow drifts or blizzards. If we want snow, we go to Julian and play in it for a few hours before taking the short drive back to weather that is the envy of the world. Let’s face it, here the sun shines bright and the skies are clear almost every minute of every day.

Yes, times are tough financially for many of us, but when you really, honestly think about it, the blessings outweigh the curses in almost every case. So, as the year winds down and the holidays begin, I urge you to think about the good things, focus on the positive and have a blessed and happy holiday.

Is a Reverse Mortgage Right For You?

By Joel Persinger

By Joel PersingerYourRealEstateDude.com

I received an email from a friend the other day inquiring about the viability of a reverse mortgage for his parents. It was one of several I have received recently and the tone of each and every one of them has been the same. The kids are worried that their parents are making a horrible mistake by opting for a reverse mortgage. So, what exactly is a “reverse” mortgage anyway?

A reverse mortgage is nothing but a tool to help older folks improve their lifestyles by accessing the equity in their personal homes without having to make a mortgage payment. While a normal home loan comes with a monthly payment which includes the interest on the loan, a reverse mortgage simply adds the interest due each month to the loan amount. The loan and the interest are paid back when the borrower moves or passes away. Thus, a senior with a reverse mortgage can borrow against his equity without having to make a payment.

The scary part for most people is the idea that the loan amount will get bigger each month because the interest is being added to the balance due. In other words, if you borrowed $100,000 against the equity in your home by using a home equity line of credit at an interest rate of 8.75 percent, you would have to write a check each month to make an interest only payment of $729.17. However, if you borrowed the same $100,000 at the same 8.75 percent interest using a reverse mortgage, the monthly $729.17 interest would simply be added to the amount you owe. You would never make a monthly payment.

This is an almost magical concept for many seniors. When a senior is barely making ends meet, eliminating the mortgage payment can do wonders for their financial picture. Likewise, many seniors who have small or perhaps no mortgage payments are struggling to survive on the fixed income of social security. A reverse mortgage allows them to use some of the equity from their home to supplement their income without risking the loss of their home. Yes, you read correctly. A reverse mortgage does not place a senior at risk of losing his or her home. In fact, the very concept of a reverse mortgage is designed around the idea of allowing seniors to live at home as long as they wish.

There are many misconceptions about reverse mortgages, so here are some of the basics. Everyone who is on the title to the home must be at least 62 years of age, there must be sufficient equity in the home, the home must be the borrowers personal residence, there are no mortgage payments, there is no income qualification and no required credit score, the loan does not need to be paid back until the last borrower sells, moves or passes away and neither the borrowers or their heirs will ever owe more than the value of the home at the time that the loan comes due.

While this all sounds great, there are some negative points as well. The loans are expensive compared to other types of home loans. This is due in part to the fact that the lender is insuring against you or your heirs ever having to pay back more than the home is worth. There may also be some hiccups for those who have gotten remarried to a younger spouse. As I mentioned earlier, everyone involved must be at least 62 years of age.

But, for most folks who have equity in their homes and who need to supplement their retirement incomes or would just like to improve their lifestyles, reverse mortgages could be just what the doctor ordered.

Subscribe to:

Posts (Atom)